By \xa0National Banking College

Fluctuations in exchange rates play a vital role in maintaining macroeconomic stability in Ghana. In the past, the Ghanaian cedi has experienced continuous decline because of issues like long-term trade deficits, financial instability, rising inflation, and unfavorable international economic situations.

For instance, the cedi declined by almost 24% in 2024, ranking it as the fourth weakest currency in West Africa that year, as stated in the World Bank Africa Pulse Report (April 2025).

Nevertheless, 2025 has seen a significant recovery. The cedi emerged as the top-performing currency globally in the second quarter of 2025, rising by roughly 30–40% from April to June 2025, recovering from a low of GHS 15.56/USD in early April to approximately GHS 10.28/USD by June (Reuters, 2025, S&P Global, June 2025).

Grasping the reasons for the cedi's recent strengthening and its wider macroeconomic effects is crucial for businesses, financial organizations, government officials, and individuals. Although a stronger cedi may lower import costs, alleviate inflation (which dropped to 18.4% in May 2025, the lowest since 2021), and boost real earnings, it can also:

- Erode export competitiveness,

- Reduced amount of money sent back in local currency,

- And impact bank balance sheets, particularly those with exposure to foreign currency positions.

This piece offers an in-depth look at the recent rise in the value of the cedi. It explores the factors behind this movement, emphasizes effects on different sectors, and presents important policy suggestions to help stakeholders react appropriately and maintain stability in a changing currency scenario.

Currency Exchange Patterns in Ghana

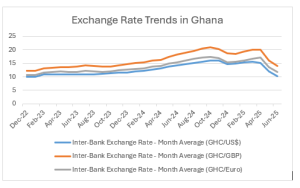

Fluctuations in exchange rates continue to serve as a key measure of Ghana's macroeconomic stability, affecting inflation, international trade, and investment patterns. From December 2022 to June 2025, the Ghanaian cedi faced considerable instability compared to the US dollar, British pound, and euro, indicating both external influences and domestic policy actions.

By the end of 2022, the cedi began to show signs of recovery after a challenging final quarter. The official interbank exchange rates stood at GHS 10.03 per US dollar, GHS 12.24 per pound, and GHS 10.62 per euro in December 2022. These rates indicated a slight improvement from earlier months, mainly due to actions taken by the Bank of Ghana and a seasonal increase in foreign currency availability.

In early 2023, the cedi saw additional improvements. By January, the currency slightly increased to GHS 9.91 per USD, while staying stable at GHS 12.13 per GBP and GHS 10.70 per EUR. However, this pattern changed gradually starting in February. Throughout 2023 and into early 2024, the cedi encountered renewed challenges, caused by delays in donor funding, increased import demand, and global monetary tightening. By March 2024, interbank rates had declined to roughly GHS 12.67 per USD, GHS 16.11 per GBP, and GHS 13.78 per EUR.

The most notable period of devaluation for the cedi took place from April to October 2024. In this phase, the exchange rate reached a high of GHS 15.99 per dollar, GHS 20.86 per pound, and GHS 17.42 per euro, indicating the severity of the pressure on all three major currencies. The greatest declines were seen against the pound, due to its strength compared to the dollar and euro, as well as Ghana's trade and remittance links with the UK.

Indications of recovery started to appear in November 2024. By December, the cedi showed a slight increase, reaching GHS 14.78 per USD, GHS 18.69 per GBP, and GHS 15.47 per EUR. This improvement gained momentum during the first half of 2025, particularly in the second quarter. From April to June, the cedi saw a significant rise, dropping from GHS 15.22 to 10.28 against the dollar, and from GHS 19.98 to 13.96 against the pound. A comparable pattern was noted against the euro, as the exchange rate increased from GHS 17.09 to 11.86 during the same time frame.

These variations demonstrate the cedi's responsiveness to both local and global factors. A comparative analysis of monthly exchange rate changes among the three currencies is shown in Figure 1, emphasizing the alternating phases of decline and increase over the 31 months.

Figure 1: Fluctuations in Currency Exchange Rates in Ghana

Source: https://www.bog.gov.gh/economic-data/exchange-rate/

Comparison of Regional Currency Performance Against USD

Provided by SyndiGate Media Inc. (Syndigate.info).