By Kwame Asante (Director of Executive, Structured Solutions Development, Cash, Standard Chartered Bank)

The African Growth and Opportunity Act (AGOA), a significant U.S. trade program introduced in 2000, is now encountering an uncertain path as renewal talks are delayed in Washington. Should it not be extended, this would signify the conclusion of a 20-year preferential trade arrangement that has influenced economic ties between Africa and the U.S., especially within industries like textiles, farming, and light industry.

The greatest effect would be experienced by countries such as Kenya, South Africa, Ghana, and Nigeria, which have utilized AGOA to expand their exports and draw in investments.

The AGOA offers duty-free entry into the U.S. market for more than 6,500 items from 35 qualifying sub-Saharan African nations. It has encouraged export-driven growth, employment opportunities, and industrial development, particularly within labor-heavy sectors.

Upcoming Turbulence: What's on the Line

In Kenya, the clothing industry has received the main advantage from AGOA, with more than 90% of fabric exports heading to the United States. The initiative provides around 58,000 direct employment opportunities, mostly occupied by women in export processing zones. Without AGOA, these companies are at risk due to increasing tariffs and reduced competitiveness.

South Africa, home to one of Africa's most varied economies, has leveraged AGOA benefits to boost exports of agricultural products like citrus fruits and wine, along with vehicles and manufacturing items. Losing AGOA would reduce export revenues, limit employment opportunities, and interfere with supply networks that aid the larger Southern African Development Community (SADC) region.

Ghana and Nigeria have also utilized AGOA to boost non-traditional exports. Ghana's clothing exports and agricultural products like yams, pineapples, and cocoa-related items have secured a steady market through the program. Nigeria, which previously depended heavily on oil exports under AGOA, has made progress in developing its light manufacturing and food processing industries. These achievements are now in jeopardy.

In addition to the figures, ending AGOA would mark a step back in Africa's efforts to develop its industries, generate employment, and achieve inclusive economic growth. It would also hinder progress in establishing robust supply chains throughout the continent.

AfCFTA: A Key Shift for Strength

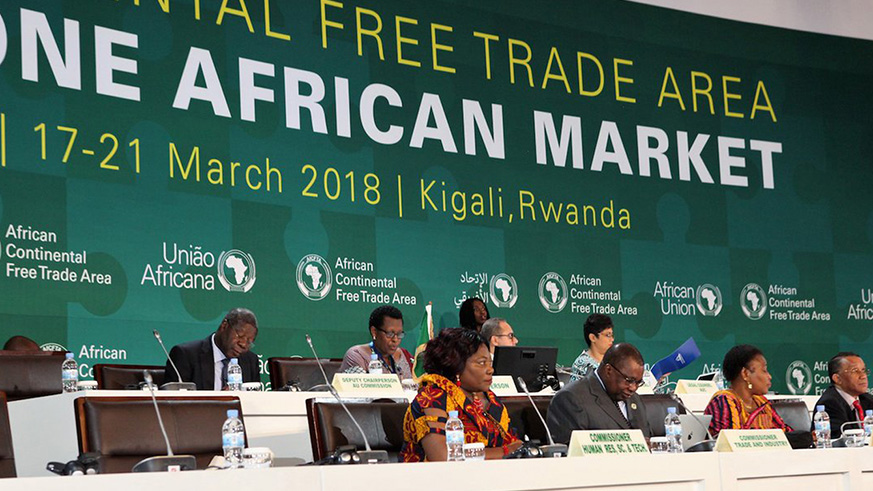

The African Continental Free Trade Area (AfCFTA) presents a different approach, moving the focus from external preferences towards creating a strong, unified African market. By bringing together 54 nations with a total population of 1.4 billion and a GDP of $3.4 trillion, AfCFTA seeks to increase trade within Africa, which currently stands below 17%, in contrast to over 60% in Europe and Asia.

At its foundation, AfCFTA aims to strengthen regional value chains. Instead of exporting raw resources, African nations can work together to create final products, boost industrial strength, and increase job opportunities. Important industries like textiles, processed foods, automotive parts, and medicines, which once gained advantages from AGOA, can now be focused on meeting rising demand within Africa.

Furthermore, AfCFTA offers a structure for Africa to engage with international partners from a stronger stance. It highlights the continent's goal to shape its trade policies around common prosperity, self-reliance, and coordinated strategies.

Progress and Priorities

The AfCFTA rollout has achieved considerable progress:

- All 54 nations belonging to the African Union have signed the accord, with 49 having approved it.

- The Guided Trade Initiative, introduced in 2022, is facilitating commerce in accordance with AfCFTA regulations, showing encouraging initial outcomes.

- Four key industries — Agro-processing, Pharmaceuticals, Automotives, and Transportation & Logistics — have been identified for regional value chain development.

- Agreements concerning Products and Services, Investment, Competition Rules, Intellectual Property, and online trade have been discussed and approved.

- Tariff schedules and origin rules now apply to 92% of goods exchanged. Textile and automotive regulations are almost finalized.

- The Pan-African Payment and Settlement System (PAPSS) is now active, linking more than 20 central banks and 160 commercial banks to facilitate transactions in local currencies.

- Seven countries now allow African citizens to enter without a visa, while 24 provide electronic visas.

- An AfCFTA Adjustment Fund, which includes a Base Fund (for technical support), General Fund (for trade infrastructure), and Credit Fund (for enhancing the capabilities of SMEs and the private sector), has been introduced to assist nations in transitioning and investing in trade-supporting systems.

These advancements go beyond mere policy successes, marking essential progress toward a new regional economic system.

To quicken progress, officials should concentrate on:

- Completing the alignment of customs procedures, digital trade frameworks, and product regulations.

- Funding developments including ports, transportation routes, and distribution centers.

- Allowing small and medium-sized enterprises, which constitute more than 80% of African businesses, to enter formal markets, obtain financial support, and meet certification requirements through the AfCFTA.

Implications for African Businesses

The AfCFTA offers a significant chance for businesses to thrive. It provides entry into a market that is becoming more open across 54 nations, presenting larger opportunities and fresh consumer groups. Lower tariffs, easier origin rules, and improved transportation networks make trading between countries more practical and less hazardous.

To benefit, companies must:

- Sign up with the national AfCFTA secretariats.

- Adhere to the certification and origin regulations.

- Place themselves in a favorable position to engage with local supply networks.

Pioneers, especially within manufacturing, transportation, and agricultural processing, are positioned to achieve a competitive edge as the trade environment evolves.

How We Can Help

With a 150-year history on the continent, Standard Chartered is actively helping clients manage and gain advantages from AfCFTA. We offer:

- Availability of funding and online commerce and cash systems.

- Policy recommendations and strategic guidance on AfCFTA; and

- Services designed to assist companies in expanding across regions.

Our objective is to link clients with emerging growth areas, facilitate the movement of capital, and promote equitable trade throughout Africa.

Final Thoughts: Africa at a Critical Turning Point

The possible termination of AGOA signifies a crucial turning point in the economic ties between Africa and the U.S. However, instead of perceiving it as a disadvantage, it should be regarded as an opportunity for autonomy. The AfCFTA offers a framework to shape a new story, focused on growth driven by African initiatives, trade within the continent, and the development of regional value chains and integration.

The necessary policies and tools have been established. The goal is evident. What is left is unified action. Government officials, companies, and development allies need to collaborate to ensure AfCFTA becomes more than a trade deal, but a powerful driver of growth across the continent.

Africa is entering a new era of trade, this time according to its own conditions.

Provided by SyndiGate Media Inc.Syndigate.info).